内容介绍:

http://www.mtksj.com/uploads/allimg/221022/1-221022161S3516.jpg|http://www.mtksj.com/uploads/allimg/

在人们的印象中,玻璃是一种易碎透明的材料,而且由于碎片尖锐容易伤人,安全性并不强。然而随着科技的发展,人们不但能够将玻璃的天然优势充分发挥,还能够调整其性能,弥补它的缺点。汽车贴膜和建筑贴膜有哪些方面

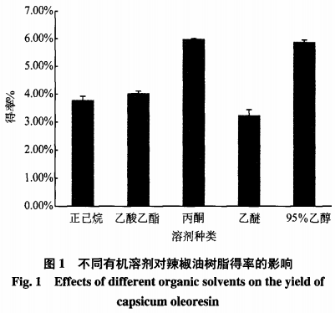

二、结果与分析1、有机溶剂的选择由图1可知,乙醚、正己烷和乙酸乙酯作为提取溶剂时,辣椒油树脂得率较低;丙酮和95%乙醇作为提取溶剂时,得率较高,分别为5.99%和5.88%。但由于乙醇提取得到的杂质较

现如今,玻璃越来越受到消费者的青睐,不但有磨砂玻璃、热熔玻璃、彩绘玻璃等装饰效果较强的艺术玻璃,还有各种功能型玻璃,例如隔音降噪的夹胶玻璃、中空玻璃和隔热阻燃的防火玻璃等。本篇文章将介绍发电玻璃的结构

http://pic1.k1u.com/k1u/mb/d/file/20240524/1716538405455484_836_10000.jpg|http://pic1.k1u.com/k1u/mb

泰国试管婴儿成功率泰国是一个备受国际关注的试管婴儿治疗中心,拥有着高水平的医学技术和先进的设备。据医疗统计数据显示,泰国试管婴儿的总成功率在60%-70%之间,高于世界其他地区的普遍水平。而针对一些特

玻璃品种多,用途广,除了常见常用的石英玻璃、钢化玻璃以外,还有光学玻璃、变色玻璃、夹层玻璃等各种类型。由于玻璃种类丰富,想要挑选合适的类型便更显重要。为了能够找到合适的玻璃胶,我们需要对各种玻璃有所了

中国消费者报北京讯记者贾珺)5月10日,北京市市场监管局对外发布2024民生领域“铁拳”行动中查处的7起典型案例,其中北京市石景山区市场监管局依法对北京创博宏安电动车销售有限公司从事经营性改装电动自行

http://www.anyangxp.com/zb_users/upload/2024/05/20240521151911171627595192550.jpeg|http://www.anyang

中国消费者报长春讯马田记者李洪涛)“太感谢你们了,本来我都以为这项业务办不成了。现在有了‘容缺办理’,办事太方便了。”4月15日上午,在吉林省长春市市场监管局朝阳分局审批窗口,长春参公馆酒店负责人李先

随着经济的发展与科学的进步,玻璃行业也不断进步,在研发新品种的同时也对原有的玻璃种类进行了加强。各种类型的深加工玻璃逐渐取代普通平板玻璃,在各自的应用领域大放异彩。为了能够买到质量更好、价格合理的彩色

玻璃品种多,用途广,除了常见常用的石英玻璃、钢化玻璃以外,还有光学玻璃、变色玻璃、夹层玻璃等各种类型。由于玻璃种类丰富,想要挑选合适的类型便更显重要。为了能够找到合适的玻璃胶,我们需要对各种玻璃有所了

https://image11.m1905.cn/uploadfile/2024/0417/20240417024258288460.jpg

中国消费者报报道为规范非学科类校外培训机构合同行为,预防和减少消费类合同纠纷,近日,江苏省镇江市市场监管局联合市消协对23家非学科类校外培训机构的合同不公平格式条款进行了梳理点评,提醒广大学生家长积极

随着浮法玻璃技术的出现,大批量制造平整均匀的优异玻璃成为可能,同时也使深加工玻璃的种类愈加丰富。除了常用的高度度钢化玻璃以外,还有注重隐私保护的磨砂玻璃、调光玻璃,增强防弹安全性能的夹层玻璃、夹丝玻璃

预糊化淀粉是一种加工简单、用途广泛的变性淀粉,应用时只要用冷水调成糊,避免了加热糊化的过程。预糊化淀粉具有增稠、分散性好、黏度高、亲油亲水性好等特点,被广泛应用于医药、食品、石油钻井、铸造等系列行业中

http://www.hwenz.com/pic/感情好文感情电台案牍少篇2024年4月4日感情类小漫笔致本身.jpg

1月21日,国家统计局召开新闻发布会,发布2018年国民经济运行情况。初步核算,2018年国内生产总值900309亿元,按可比价格计算,比上年增长6.6%,实现了6.5%左右的预期发展目标。分产业看,

中国消费者报福州讯陈重捷记者张文章)电池同样有“聚能环”色彩、电池底部同样有“南孚”钢印,哪个真哪个假?近期,不少假“南孚”电池悄无声息地混入市场,不仅消费者难辨真伪,连商家也是一头雾水。4月16日,

中国消费者报北京讯记者贾珺、万晓东、李建)记者5月16日从北京市市场监管局获悉,推动京津冀协同发展10年来,北京市市场监管局、天津市市场监管委和河北省市场监管局全面落实《京津冀协同发展规划纲要》《深入